Plastic depolymerization: what is it and why does it matter now?

Plastic depolymerization is the chemical conversion of waste polymers back into monomers or valuable chemicals. Unlike traditional recycling, which often degrades quality, this approach regenerates near-virgin feedstock suitable for new applications. With mounting pressure from policymakers, consumers, and brands, this process has become central to creating a true circular economy for plastics.

The method spans multiple routes—thermal, catalytic, hydrolytic, electrochemical, and enzymatic—each designed for different types of polymers and waste streams. In short, plastic depolymerization unlocks value where mechanical recycling falls short, addressing contamination, color, or mixed inputs.

How is plastic depolymerization different from mechanical recycling?

Mechanical recycling re-melts and reshapes plastics but cannot remove additives or dyes. Properties deteriorate after several cycles, limiting reuse. By contrast, chemical recycling approaches such as PET depolymerization reverse polymers back into original monomers. These purified molecules can then re-enter manufacturing without loss of quality.

This distinction makes the process critical for packaging, textiles, and engineering plastics that demand strict performance. In essence, plastic depolymerization is not just recycling; it’s regeneration, enabling industries to meet recycled-content mandates while reducing dependence on virgin feedstocks.

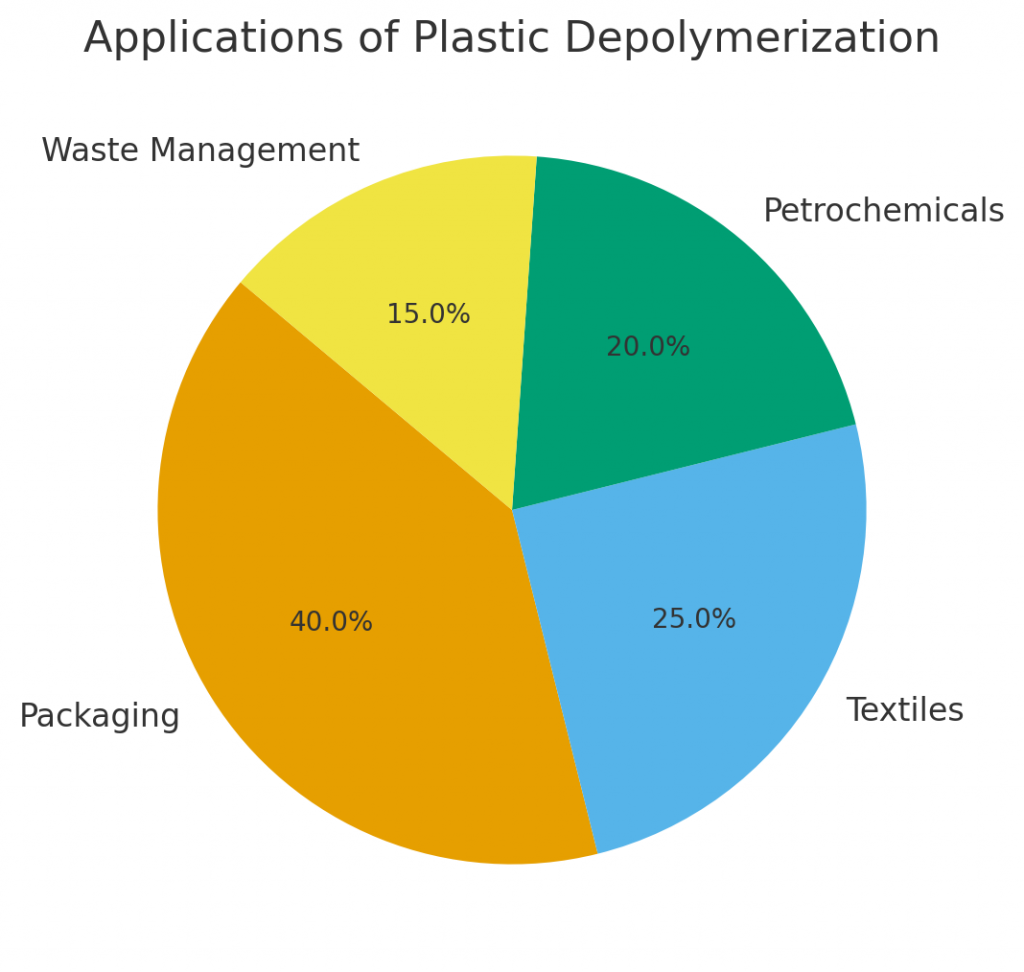

Which markets and applications benefit most from this process?

The most promising applications include:

- Packaging: Turning PET bottles, trays, and films back into high-grade monomers.

- Textiles: Fiber-to-fiber enzymatic recycling for polyester apparel.

- Waste management: Decentralized plants treating mixed or contaminated waste.

- Petrochemicals: Catalytic routes producing refinery-ready oils, waxes, and aromatics.

Together, these segments reflect the broad industrial appetite for technologies that enable sustainable polymer innovation. For governments and brands alike, the outcome is reduced landfill, lower incineration, and new economic models based on feedstock circularity.

What technology pathways enable chemical recycling today?

Thermal cracking (pyrolysis, gasification) breaks polyolefins into oils, gases, and waxes. Catalytic depolymerization introduces selective catalysts that lower energy use and create high-value hydrocarbons. Hydrolytic methods target condensation polymers like PET and nylon, cleaving ester or amide bonds to yield pure monomers.

Meanwhile, electrochemical approaches use redox reactions at low temperature, promising modular, on-site deployment. Finally, enzymatic recycling leverages engineered enzymes such as PETase to convert plastic into building blocks under mild conditions. These technology families collectively form the foundation of advanced recycling technologies.

Who are the major companies commercializing these solutions?

Several global leaders are shaping the competitive landscape:

- Thermal: Agilyx, Brightmark, Quantafuel, Plastic Energy.

- Catalytic: Licella (Cat-HTR™), Mura (HydroPRS™), Anellotech, BlueAlp.

- Hydrolytic: Carbios, Loop Industries, Gr3n, BASF.

- Electrochemical: Sulzer, Ovivo, Carbon Clean Solutions.

- Enzymatic: Carbios, Protein Evolution, DePoly.

These companies demonstrate that plastic depolymerization is moving from pilot studies to full-scale industrial operations, often integrated into chemical parks or waste-management systems.

Which startups are reshaping innovation in this field?

Young companies are carving out niches with specialized processes:

- CreaCycle develops solvent-assisted systems.

- Protein Evolution uses AI-designed enzymes.

- DePoly pioneers low-temperature PET recycling.

- Gr3n applies microwave-assisted hydrolysis.

- Bordiamond and Green Polymer Technologies advance electrochemical modules.

These recycling startups are vital in bridging lab success to scalable business, ensuring that plastic waste to monomers becomes a commercial reality.

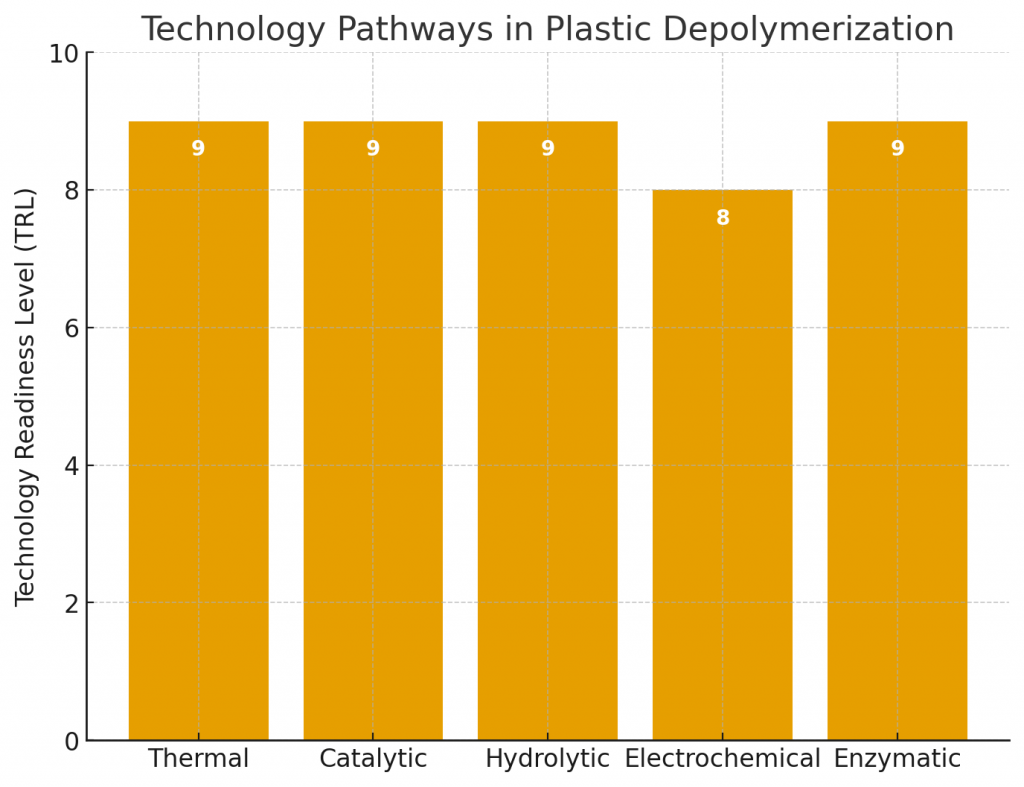

What do patents and TRL levels reveal about maturity?

Patent landscapes show maturity and geography:

- Thermal: TRL 9, widely commercial.

- Catalytic: TRL 9, expanding fast.

- Hydrolytic: TRL 9, strong for PET.

- Enzymatic: TRL 9, nearing industrial rollout.

- Electrochemical: TRL 8, in late pilot phase.

Japan leads thermal patents, China leads catalytic, while the US dominates hydrolytic, enzymatic, and electrochemical filings. For investors, these signals confirm that plastic depolymerization is largely de-risked for PET and polystyrene, while new electrochemical solutions remain an emerging frontier.

Which standards and policies guide adoption?

Adoption is influenced by clear benchmarks:

- ASTM D5577-19 – contaminant detection.

- ASTM D7475-20 – biodegradation testing.

- ISO 23832:2021 – physical degradation rate.

- ISO/WD 15270-2 – recycling guidelines.

- GB/T 37821-2019 – Chinese technical standard.

These standards validate process claims, ensure consistent quality, and provide confidence to regulators and buyers. Compliance is essential for scaling chemical recycling infrastructure globally.

Where is the research community focusing its efforts?

Universities and consortia are pushing the science further:

- BOTTLE™ (DOE) targets catalytic and enzymatic advances.

- iCOUP and CUWP explore hybrid flowsheets.

- BioICEP and UPLIFT combine biological and chemical methods.

At the same time, conferences such as ACS and WasteEng highlight novel catalysts, enzyme immobilization, and AI-driven reactor control. For innovators, tracking these venues is the fastest way to stay ahead in plastic depolymerization breakthroughs.

Which real-world deployments highlight progress?

Several facilities demonstrate commercial readiness:

- Carbios’ PET enzymatic plant in France (planned 2025).

- Mura’s HydroPRS™ plant in the UK (>20,000 t/yr).

- ExxonMobil’s advanced recycling lines targeting 1 billion pounds annually by 2027.

- Loop Industries partnering on low-temperature PET plants.

These projects prove that plastic depolymerization is no longer theoretical; it is being embedded into global supply chains.

What challenges remain before full adoption?

Despite progress, hurdles persist:

- Feedstock economics – fluctuating bale prices.

- Selectivity and efficiency – durability of catalysts and enzymes.

- Quality assurance – meeting brand-owner specs.

Responses include co-location with waste facilities, AI-driven process control, and hybrid systems combining solvent pretreatment with enzymatic finishing. Overcoming these challenges will define the scalability of plastic depolymerization in the coming decade.

What is the future outlook for the next decade?

Expect PET and polystyrene solutions to dominate in the near term, with modular polyolefin systems gaining ground later. Advances in catalytic depolymerization and enzymatic recycling will cut energy costs while smart reactors optimize yields. Government mandates and brand commitments will ensure strong demand.

Ultimately, plastic depolymerization will evolve from niche innovation into a mainstream enabler of the circular economy, reshaping how industries design, collect, and reuse materials.

Conclusion: how can PatentsKart accelerate your strategy?

PatentsKart helps organizations navigate the complex landscape of plastic depolymerization. From IP landscaping to partner scouting, our team ensures you understand technology readiness, avoid patent collisions, and identify market opportunities. Whether you’re exploring advanced recycling technologies or scaling sustainable polymer innovation, we provide the expertise to move faster with confidence.

Visit www.patentskart.com or contact us at info@patentskart.com to learn more.

FAQs

1) Which plastics are best suited for chemical recycling today?

Condensation polymers like PET and nylon are the strongest candidates, with PET depolymerization already proving commercially viable. PatentsKart helps identify process partners and patent risks for each material.

2) Is chemical depolymerization economically competitive with mechanical methods?

Yes, when high-purity monomers are required. While capex can be higher, quality and market value justify investment. PatentsKart models IP-sensitive cost factors for clients.

3) How does enzymatic recycling support circular textiles?

By converting polyester fibers into reusable monomers, enzymatic recycling enables true fiber-to-fiber loops. PatentsKart validates claims and standards compliance for textile brands.

4) Which regions lead in patents and innovation?

Japan leads in thermal, China in catalytic, and the US in hydrolytic and enzymatic. We align patent strategy with geographic strengths for maximum impact.

5) What standards should be met before scaling a recycling plant?

ASTM and ISO standards guide quality, biodegradability, and recovery metrics. PatentsKart ensures your technology portfolio aligns with these frameworks.