What is Synthetic Biology for Bio-Manufacturing and why does it matter?

The bioeconomy is moving from promise to production. Around the world, teams are engineering microbes, yeasts, and cell systems to make fuels, foods, medicines, and materials with lower emissions and greater resilience than fossil supply chains. Synthetic Biology for Bio-Manufacturing sits at the center of this shift, bringing programmable biology, automation, and data science together so new products move from lab bench to plant floor faster.

In practical terms, the field replaces extractive and petrochemical routes with living factories. Rather than digging oil or harvesting scarce inputs, designers program cells to synthesize target molecules, and then scale them in fermenters. For companies under pressure to hit climate goals and improve unit economics, Synthetic Biology for Bio-Manufacturing offers a credible path: modular design, high-throughput testing, and rapid iteration that collectively reduce time to market.

How does synthetic biology actually power bio-manufacturing?

The workflow looks a lot like software development, except the code is DNA. Scientists design genetic circuits with computation, build them with automated DNA assembly, test thousands of variants in parallel, and learn from the data to improve the next round. This design–build–test–learn loop is the engine behind Synthetic Biology for Bio-Manufacturing, enabling precise control over pathways and yields.

Key steps include:

- Design: Computational strain design and pathway modeling guide which edits to make.

- Build: DNA sequences are written, assembled, and integrated into microbial hosts.

- Test: High-throughput assays evaluate titer, rate, and yield under realistic conditions.

- Learn: Machine learning discovers patterns that boost performance and robustness.

- Scale: Pilot fermentation gives way to 50,000–200,000 L production lines.

Because cells are programmable, Synthetic Biology for Bio-Manufacturing can redirect carbon into biochemicals that replace commodity inputs, unlock novel materials, or enable entirely new categories of products.

What are the highest-impact applications right now?

Commercial traction is broad. In health, synthetic biology enables rapid vaccine platforms, antibody manufacturing, and precision therapeutics. In food and agriculture, fermentation produces alternative proteins, dairy-free ingredients, and microbes that enhance soil health. In chemicals and energy, organisms convert waste gases and biomass into ethanol, sustainable aviation fuel, and specialty monomers. In materials, engineered proteins deliver leather-like textiles and high-performance fibers.

Across these domains, Synthetic Biology for Bio-Manufacturing lowers dependence on volatile commodities and aligns production with circular-economy targets. The result is less waste, shorter supply chains, and more resilient sourcing for brands and governments.

Which companies are leading the charge globally?

Several platforms anchor the space. Ginkgo Bioworks focuses on cell programming at scale with foundry automation. Novozymes (now Novonesis) extends enzyme engineering into industrial biocatalysis. Moderna applies programmable biology to mRNA therapies. BASF and DSM explore bio-based chemicals for materials and agriculture. On the fuels side, LanzaTech transforms waste gases into ethanol and derivative chemicals.

These enterprises act as global leaders in bio-manufacturing with synthetic biology, shaping standards, building IP portfolios, and partnering with consumer brands. Their work accelerates the maturation of Synthetic Biology for Bio-Manufacturing by de-risking unit operations and proving commercial viability.

Which startups are redefining the frontier?

Breakout startups are pushing into new categories. Bolt Threads and Spiber craft protein-based materials. Perfect Day and EVERY produce animal-free dairy and egg proteins. Pivot Bio improves nitrogen management with microbial solutions. Solugen builds fossil-free specialty chemicals using enzyme cascades. Each of these firms turns scientific insight into products people can touch and use.

Investors value speed to market and defensible advantages. Startups that master strain performance, process integration, and customer collaborations help the overall ecosystem of Synthetic Biology for Bio-Manufacturing reach scale faster.

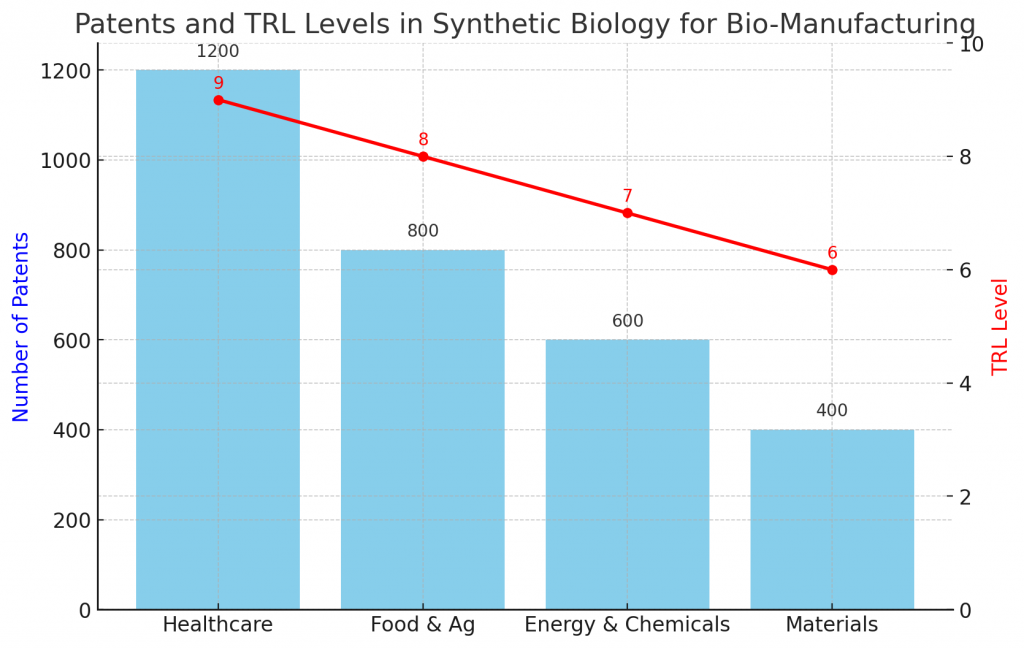

How do patents and TRL levels signal maturity?

Patents map innovation hot spots, while TRL (technology readiness level) benchmarks practical maturity. A strong portfolio around pathway engineering, host optimization, and downstream processing suggests defensibility. Meanwhile, higher TRL indicates proven performance in pilots and early commercial runs.

When diligence teams study a space, they look for dense clusters of filings tied to specific value chains. In parallel, they track which programs are moving from TRL 5–6 lab validation to TRL 7–9 pilot and plant operation. For decision-makers, the combined picture clarifies where Synthetic Biology for Bio-Manufacturing is de-risked and where additional experimentation is still required.

What global trends are accelerating adoption?

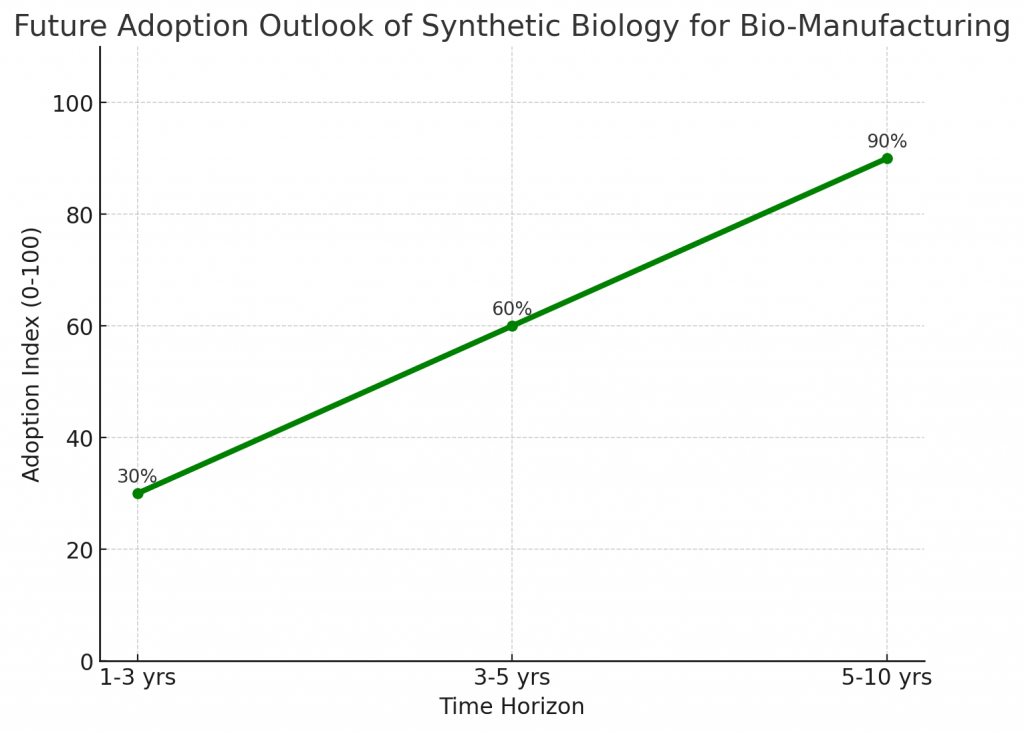

Three dynamics stand out. First, policy tailwinds—such as Inflation Reduction Act provisions, EU Green Deal incentives, and national bioeconomy strategies—lower capital risk. Second, supply chain resilience now ranks alongside price in procurement decisions, favoring regionalized, modular production. Third, digital tooling—from AI strain design to automated analytics—raises the learning rate of teams.

Together these shifts make Synthetic Biology for Bio-Manufacturing more attractive to strategists who need both sustainability gains and predictable costs. The outcome is more pilot plants, more offtake agreements, and a faster cadence from proof of concept to revenue.

What challenges should operators plan for early?

Every new production paradigm faces headwinds. Four are common. Scale-up risk: strains that shine in 2 L reactors can stumble at 20,000 L without robust process engineering. Unit economics: feedstock price, yield stability, and downstream work-up determine margins. Regulation: food, pharma, and environmental approvals add time. Public trust: transparent communication and safety practices build acceptance.

Successful teams design with constraints in mind. They invest in process control, redundancy, and supplier diversification. They also model multiple price scenarios to ensure Synthetic Biology for Bio-Manufacturing remains competitive through commodity cycles.

What does the next decade look like for the field?

Near term, expect more consumer products made with engineered fermentation—cosmetics, flavors, materials, and functional ingredients. Mid term, the focus shifts to platform chemicals and sustainable aviation fuel through improved pathways and co-product valorization. Longer term, hybrid systems that combine electrosynthesis with biology may crack tougher carbon problems.

As costs drop and reliability improves, Synthetic Biology for Bio-Manufacturing will integrate into mainstream supply chains. Companies will treat biology as a design space: specify a molecule, choose a host, simulate the process, and commission capacity—much like fabless models in semiconductors.

What real-world case studies prove commercial viability?

Consider three patterns. First, carbon-to-chemicals pathways convert waste industrial gases into ethanol and downstream solvents at scale. Second, precision fermentation makes high-value proteins for food, beauty, and materials without animal inputs. Third, enzyme-enabled synthesis replaces harsh chemistry in specialty molecules. Together these case studies demonstrate that pilots can cross the chasm to profitable production when offtake is secured and quality is consistent.

Brand collaborations are central. Consumer companies sign multi-year agreements that justify capacity buildouts, while platform providers handle strain improvement and operations. This partnership model underpins Synthetic Biology for Bio-Manufacturing and aligns incentives around reliability, cost, and sustainability outcomes.

How should teams design a scale-up playbook that works?

Start with a one-sentence value proposition and the unit metric that matters most—dollars per kilogram, for instance. Backsolve from that number to yield, titer, and productivity targets. Treat downstream processing as co-equal with strain design; drying, filtration, and purification decide margins. Finally, simulate economics across feedstock scenarios so your plan survives commodity swings.

A credible playbook translates science into operations. It documents decision gates from lab to pilot to plant, defines statistical process control, and codifies contingency plans. Done well, this discipline turns early promise in Synthetic Biology for Bio-Manufacturing into enduring performance.

Which metrics reveal real sustainability gains?

Not all green claims are created equal. Prioritize lifecycle assessments with transparent system boundaries. Track greenhouse gas intensity per kilogram, water use, energy source mix, and end-of-life options for products and packaging. Establish third-party verification and communicate results in plain language.

When sustainability metrics guide design, teams avoid incrementalism. Instead, they optimize yields, select renewable power, and engineer recyclability. This accountability ethos strengthens the business case for Synthetic Biology for Bio-Manufacturing across regulated and consumer markets.

What does the regulatory landscape look like today?

Regulation varies by sector. Food applications navigate novel food frameworks and labeling rules. Healthcare products face stringent clinical validation and manufacturing standards. Environmental releases require biosafety and monitoring plans. Early engagement with regulators shortens timelines and builds trust.

Documentation is decisive: clear dossiers, validated methods, and traceability systems reduce review friction. Companies that integrate quality by design from day one move faster, which is why governance is a first-class pillar inside Synthetic Biology for Bio-Manufacturing programs.

Where is funding moving, and why is capital selective?

Capital is flowing to platform firms with diversified pipelines and to specialists with near-term products. Investors favor teams that own key process steps, have credible offtake partners, and can prove unit economics at pilot. Blended finance and public incentives often fill the gap between demonstration and commercial deployment.

As rates stabilize, growth equity returns to the table, but diligence is sharper. The companies that win show repeatable execution and measurable traction, which is exactly the story LPs want to hear about Synthetic Biology for Bio-Manufacturing in the next funding cycle.

How should data and AI support bio-manufacturing operations?

Data are the feedback loop for industrial biology. Automated sampling, inline sensors, and cloud LIMS systems create a high-resolution view of fermentation. AI helps detect drift, predict failures, and suggest recipe changes before yields slide. Standardized schemas ensure experiments are comparable over time.

The payoff is higher uptime and faster learning. When paired with robust change control, digital tools turn operations into a continuous-improvement engine. That is how enterprises extract durable value from Synthetic Biology for Bio-Manufacturing at scale.

What regional outlooks matter most heading into 2026?

North America leads in venture formation and scale-up capacity; Europe advances policy and standards; and Asia expands feedstock access and flexible manufacturing. Supply chains are regionalizing, which reduces shipping risk and aligns with local incentives.

For executives planning capacity, site selection now weighs renewable power availability, workforce skills, and proximity to customers. These factors accelerate adoption of Synthetic Biology for Bio-Manufacturing while balancing cost and resilience across regions.

How can PatentsKart help with strategy and execution?

PatentsKart supports leaders who want to move with confidence. We map IP landscapes to reveal white space, track competitors, and flag overlapping claims. We run freedom-to-operate reviews across target markets, align filings with product roadmaps, and identify licensing or partnership options that compress time to scale. We also benchmark TRL progress so executives can stage investments rationally.

With tailored research and actionable recommendations, we help teams convert ideas into revenue while protecting their position in Synthetic Biology for Bio-Manufacturing ecosystems.

Conclusion

The shift from extraction to fabrication is underway. Organizations that harness programmable cells, automation, and data will set the pace of the bioeconomy. With thoughtful design and disciplined execution, Synthetic Biology for Bio-Manufacturing delivers cleaner inputs, resilient supply, and compelling brands.

The opportunity is here: build the right IP, partner well, and scale responsibly. Those choices will define the winners of the next industrial era.

FAQs

Q1. What is the simplest definition of this field?

It is the engineering of organisms to manufacture molecules and materials at scale with lower emissions.

Q2. How is it different from traditional biotech?

It uses modular design, automation, and data-driven iteration to reach market faster and with tighter control.

Q3. Which sectors feel the impact first?

Food, health, materials, and chemicals see early gains, followed by fuels and advanced composites.

Q4. What raises investor confidence?

Clear unit economics, robust IP, reliable offtake partners, and steady TRL advancement toward pilot and plant.

Q5. Where should a new team start?

Validate use cases with customers, design for scale from day one, and align regulatory and IP workstreams. Additionally.