What Are bio dispersants and Why Do They Matter?

Sustainability demands that industrial formulations evolve away from fossil feedstocks. At the center of this shift are sustainable dispersants that deliver performance parity with legacy chemistries while reducing environmental harm. This article explains how select renewable molecules are engineered to control particle behaviour, the use cases where they deliver immediate commercial value, and the practical IP and scale-up considerations for companies that want to adopt these solutions. Throughout this piece we use the phrase bio dispersants to anchor the discussion on materials which are specifically designed to keep particles dispersed in liquids.

What Are the Core Properties of bio dispersants?

At a high level, these materials perform three technical functions: (1) adsorb to particle surfaces, changing interfacial energy; (2) provide steric or electrostatic barriers to aggregation; and (3) modify rheology so slurries remain pumpable and stable. Feedstocks include lignin fractions, fatty-acid esters, polysaccharide derivatives and fermentation-derived biosurfactants. Because the raw materials vary, formulators choose routes that match the process demands: low-temperature coating, high-solids pulp slurries or saline remediation fluids. Designers measure performance through particle size distribution, zeta potential and practical KPIs such as coating pickup and drying behaviour.

How Do bio dispersants Work at the Molecular Level?

Steric stabilization uses polymeric chains attached to particles so that approach causes an entropic penalty; electrostatic systems impart charge to create repulsive forces. Amphiphilic biosurfactants create micellar envelopes that reduce interfacial tension and improve wetting. In real formulations, manufacturers often blend mechanisms to balance performance and cost—e.g., a lignin-derived rheology modifier combined with a tailored copolymer backbone to deliver both colloidal stability and mill processing resilience.

What Are the Most Valuable Industrial Applications of bio dispersants?

The highest immediate value appears in paper industry dispersants: pigment and filler dispersion for coatings, retention aids in the wet end, de-inking in recycled fibre lines and barrier coating compatibility for food packaging. These interventions improve print uniformity, reduce coating defects and support circularity by lowering chemical oxygen demand in effluent streams. Secondary markets include personal care (mildness and biodegradability), paints (color stability), and adhesives (suspension of insoluble fillers).

How Are bio dispersants Applied in Environmental Remediation and Oil & Gas Operations?

In spill response, select biosurfactants disperse oil into fine droplets that biodegrade more rapidly than untreated slicks. For drilling and flow assurance, tailored dispersants manage asphaltene buildup and stabilize emulsions during produced water treatment. The performance bar is high—field trials must demonstrate comparable dispersion efficiency under variable temperatures and salinities while showing improved ecotoxicology profiles. Not every biosurfactant matches every legacy product; selection requires application-specific screening.

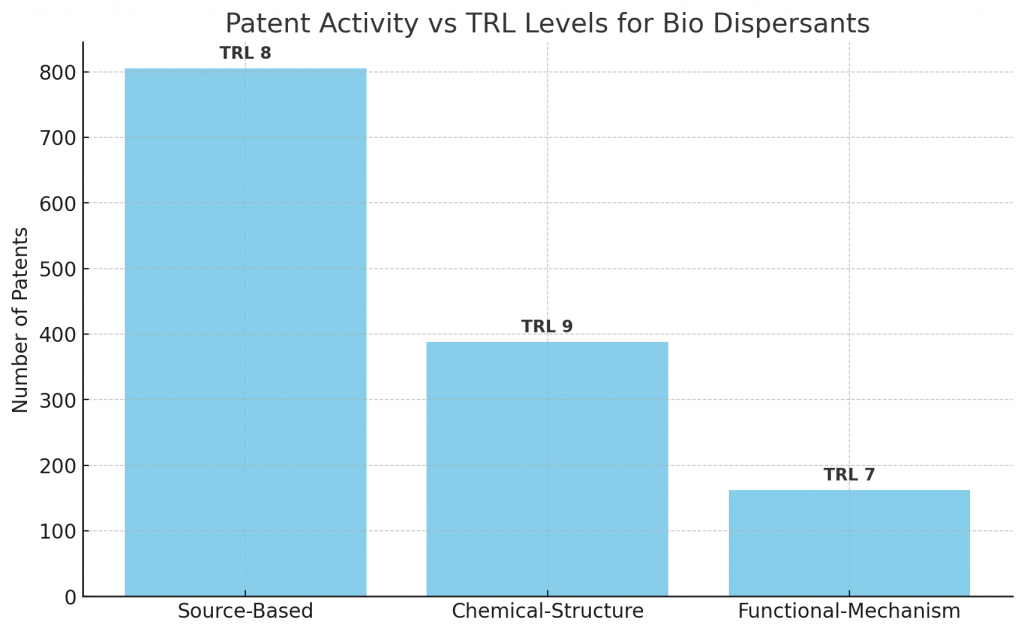

What Do Patents and TRL Tell Us About bio dispersants?

Patent activity clusters into three paths: source-based feedstock innovation, chemical-structure engineering and mechanism-led formulations. Chemical-structure solutions (engineered copolymers, graft architectures) often achieve higher TRL because they slot into existing formulation platforms and manufacturing lines. Source-based routes—lignin derivatives, fermentation-based surfactants—are moving from pilot to early commercialization as fermentation scale-up and feedstock logistics improve. Functional-mechanism strategies (novel polyelectrolyte complexes, multi-component steric systems) are advancing but generally sit at earlier TRL levels pending robust field trials.

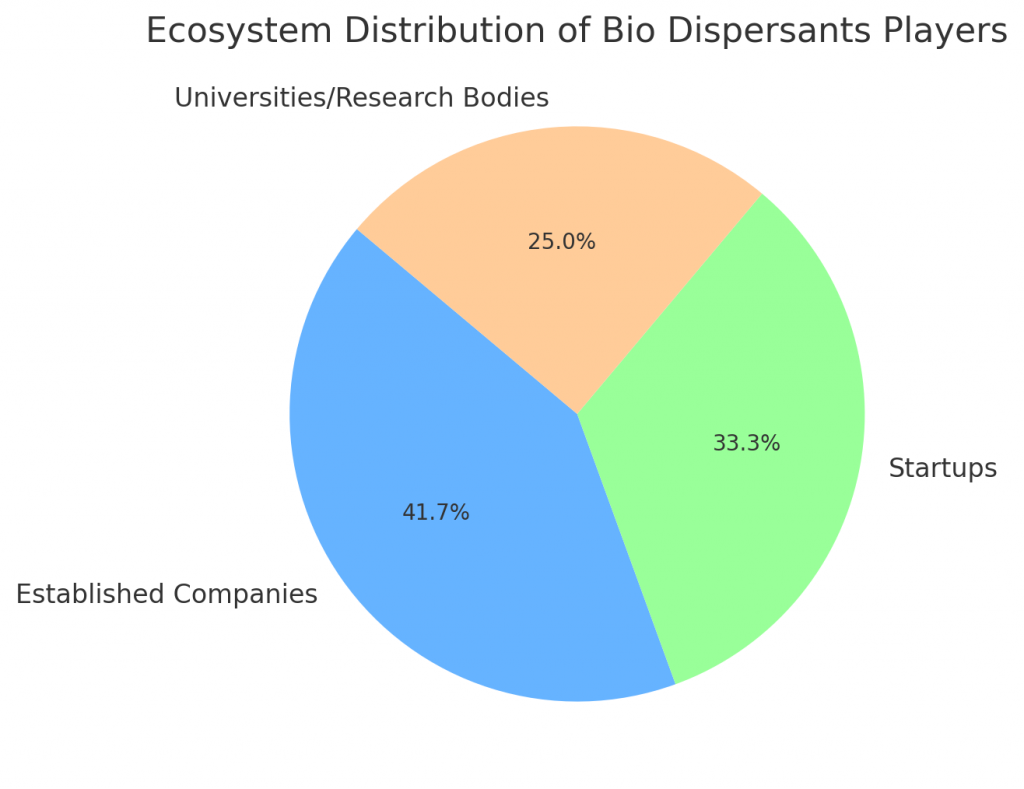

Which Companies and Startups Are Leaders in bio dispersants?

Incumbents such as Arkema, BASF, Dow and Lubrizol maintain broad patent estates and market channels for trials.

Startups—Locus, Solugen, StringBio, Dispersa and others—bring cost-disruptive bioproduction platforms and feedstock flexibility.

Collaboration between incumbents and startups is common: piloting at paper mills or joint field demonstrations for environmental applications accelerates adoption and helps clarify supply and performance tradeoffs.

What Should R&D Teams Prioritize When Developing bio dispersants?

Three priorities drive commercial uptake: compatibility (with fillers, coatings, adhesives and process equipment), lifecycle validation (complete biodegradation, ecotoxicity panels and sludge-treatment metrics), and supply security (multiple feedstock sources and logistics). Early investment in standardized analytics—laser diffraction for particle size, zeta potential, accelerated aging and shear-rate rheology—reduces iteration time during trials and provides defensible data for procurement.

What Are the Main Commercial and Regulatory Hurdles for bio dispersants?

Cost of goods, scale-up reliability and regulatory acceptance are the three common barriers. Demonstrating environmental benefit through third-party assays and aligning with recognized standards (CEN and OECD tests, ISO carbon-footprint methodologies) shortens procurement cycles. Procurement teams should request performance-based metrics rather than feedstock origin alone and include acceptance gates tied to measurable KPIs.

Roadmap: How Companies Can Move from Pilot to Production for bio dispersants

- Define performance metrics that map to specific process KPIs (e.g., ΔE color tolerance, coating pickup, solids retention).

- Run side-by-side trials at representative scales and fluids.

- Validate environmental claims with accredited laboratories and third-party assays.

- Secure feedstock contracts and build supply redundancy.

- File strategic patents on compositions, unique processing steps and end-use claims to protect commercialization pathways.

How Will bio dispersants Evolve Commercially Over the Next Five Years?

Expect hybrid solutions that blend renewable building blocks with engineered backbones to hit the performance, cost and sustainability trifecta. Investment in modular biomanufacturing and waste-to-feedstock routes (mobile micro-refineries, sidestream valorization) will compress cost curves. Early adoption will concentrate in converters and brands where sustainability provides a direct commercial advantage—specialty packaging, premium print and certified recycled products.

Analytical and Reporting Protocols

Teams should standardize test methods: particle size distribution (laser diffraction), sedimentation (e.g., LUMiSizer), zeta potential, full shear-rate rheology and accelerated aging. For environmental claims, follow OECD biodegradation tests and accredited aquatic toxicity protocols. Reporting must combine lab metadata, trial data, environmental assays and a commercial KPI sheet that procurement can sign against.

Procurement and Contracting Tips

- Procure pilot quantities through milestone contracts with clear acceptance criteria and independent lab validation.

- Insist on supply chain traceability and certificates of analysis for each lot to reduce batch variability.

- Negotiate IP terms early: decide whether the supplier retains composition IP or whether co-development yields shared filings and licensing options.

Actionable Checklist for Buyers and Innovators

- Evaluate candidate formulations (lab and pilot) for compatibility with your process and specify the acceptable performance range for dispersant applications.

- Request third-party biodegradation and ecotoxicity data for any bio-based dispersants under consideration.

- Negotiate pilot terms that include scale-up support and a clear KPI sign-off.

- Consider dual-sourcing to manage feedstock volatility for renewable dispersants.

- Map patent landscapes early to identify white spaces and freedom-to-operate.

Recommended Testing Schedule and KPIs for Buyers

Create a 12-week validation schedule with staged data gates. Weeks 1–2: lab screening with particle-size and sedimentation benchmarks. Weeks 3–6: bench-scale trials under representative shear and temperature, measuring viscosity retention and color metrics. Weeks 7–10: pilot runs at production-representative flow rates with monitoring for coating pickup, solids retention and effluent chemistry. Weeks 11–12: regulatory reporting and final acceptance testing. Sample KPIs: ΔE color tolerance, mean particle size, sediment volume after 24 hours, biodegradation percent after 28 days, and key ecotoxicology endpoints.

How PatentsKart Can Help with bio dispersants

PatentsKart provides targeted IP landscaping, freedom-to-operate (FTO) analysis and patent prosecution tailored for platform chemistries and formulation technologies. Typical deliverables include a prioritized patent landscaping report, a filing roadmap with draft claims for immediate prosecution, FTO focused on commercial geographies, and a pilot validation checklist aligning lab metrics with patentable process steps. We also support licensing negotiations and bidder evaluations so procurement teams can compare total value, not just COGS.

Conclusion

Bio dispersants represent a pragmatic pathway to more sustainable formulations with immediate industrial benefit. Companies that combine formulation science, robust testing and a clear IP strategy will convert sustainability objectives into durable competitive advantage. PatentsKart translates technical strengths into enforceable IP and commercial roadmaps that accelerate adoption while protecting market position.

FAQ

1. What are bio dispersants and how do they differ from conventional dispersants?

Bio dispersants are formulations derived from renewable resources and typically offer lower toxicity and improved biodegradability compared with petroleum-derived dispersants.

2. How do bio dispersants improve paper coating and print quality?

They stabilize pigments and fillers, reduce flocculation and control viscosity, which together enhance coating uniformity and printability on high-speed coating lines.

3. Are bio dispersants effective in marine oil spill response?

Certain biosurfactants can match conventional dispersants in dispersion efficiency while offering faster biodegradation; selection needs validation through field trials and ecotoxicology tests for specific conditions.

4. What are the key IP strategies for protecting innovations in bio dispersants?

File claims on composition, manufacturing steps and specific end-uses; maintain trade secrets around sourcing and in-line processing parameters; and run FTO searches early for target geographies.

5. How long does it take to commercialize a bio dispersant from lab to market?

Typical cycles range from 18–36 months for coatings and paper applications if pilot trials and regulatory checks proceed smoothly; environmental applications often require longer validation windows due to field complexity.