Introduction

As the world accelerates its race toward net zero, the demand for clean, scalable, and sustainable energy solutions has never been higher. Among the technologies shaping this transition, Next Generation Hydrogen Electrolysis stands out as a true game-changer. By producing hydrogen through renewable electricity, it eliminates the carbon footprint associated with fossil-fuel based methods.

But what makes this technology “next generation”? It goes beyond conventional electrolysis to offer higher efficiency, greater flexibility, and scalability for industries ranging from steelmaking to mobility. In this blog, we will explore the market potential, patent trends, maturity levels, leading companies, startups, and applications of this rapidly advancing field.

What is Next Generation Hydrogen Electrolysis?

Hydrogen electrolysis is the process of splitting water into hydrogen and oxygen using electricity. When the electricity comes from renewable sources, the hydrogen produced is entirely green.

The “next generation” label highlights advancements in electrolyzer design, efficiency, and adaptability. Four major types dominate the field:

- Alkaline Water Electrolysis (AWE) – The oldest and most widely commercialized method.

- Proton Exchange Membrane (PEM) – Offers fast response times and is ideal for pairing with intermittent renewables.

- Solid Oxide Electrolysis (SOEC) – Operates at high temperatures, achieving very high efficiency when paired with industrial heat.

- Anion Exchange Membrane (AEM) – An emerging technology that combines the advantages of alkaline and PEM systems, still in prototype stage but highly promising.

These innovations are pushing hydrogen production toward lower costs and broader deployment.

What Market Trends Are Driving Next Generation Hydrogen Electrolysis?

The global hydrogen economy is gaining unprecedented momentum. Several factors are fueling the adoption of advanced electrolysis technologies:

- Government policies and funding – The EU, U.S., and India have committed billions in hydrogen investments.

- Industrial decarbonization – Sectors such as steel, cement, and fertilizers need clean hydrogen to cut emissions.

- Corporate sustainability commitments – Energy giants like Shell, Siemens, and Linde are leading massive hydrogen projects.

- Falling renewable costs – The declining cost of solar and wind makes green hydrogen increasingly competitive.

Together, these drivers are creating a strong foundation for large-scale deployment of next generation hydrogen electrolysis.

How Do Patents Reflect the Growth of Next Generation Hydrogen Electrolysis?

Innovation in this sector is mirrored by the sharp rise in patent activity.

- 2010–2015: Steady but slow growth in filings.

- 2015–2020: Surge in patent activity, especially in PEM and SOEC.

- 2020 onwards: Rapid acceleration as new players and startups enter the market.

Leaders in patent filings include Sinopec, CNOOC, PetroChina, Aramco, and Topsoe. China, the U.S., and Europe remain the hotspots of intellectual property activity, reflecting where commercialization is advancing fastest.

Patents also reveal how companies are securing their competitive positions as the hydrogen economy expands.

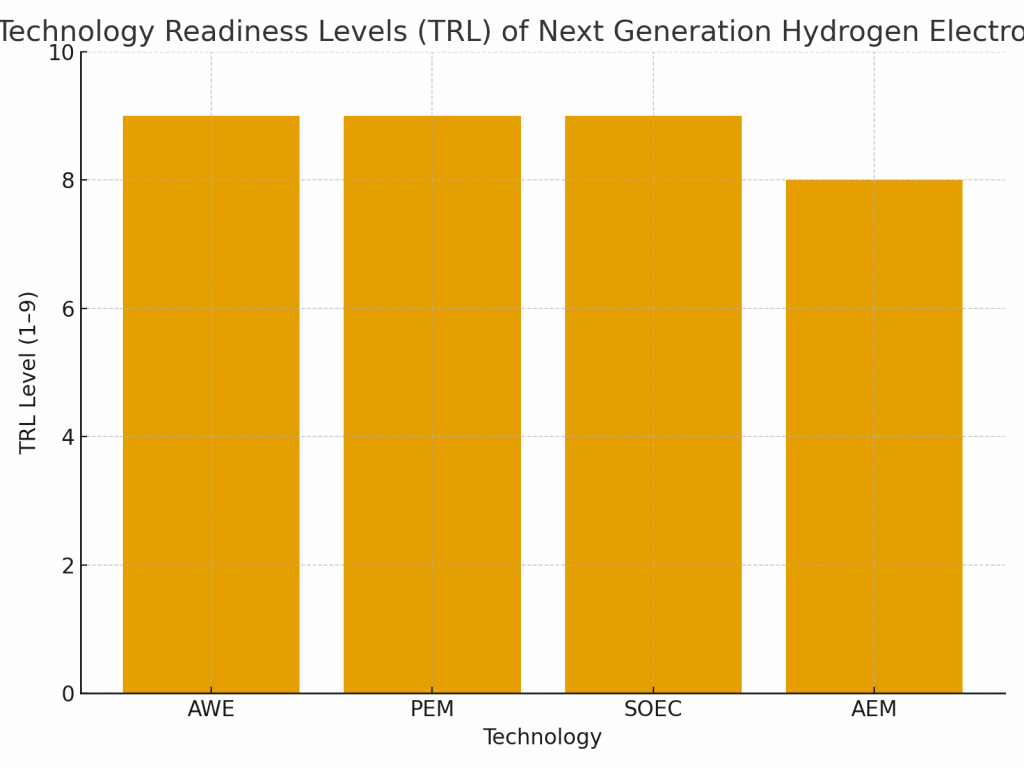

What Do Technology Readiness Levels (TRL) Tell Us?

Technology Readiness Levels (TRLs) indicate how close technologies are to full commercialization.

- AWE – TRL 9: Already commercial and widely adopted.

- PEM – TRL 9: Mature technology with growing adoption.

- SOEC – TRL 9: Commercializing rapidly in high-temperature industries.

- AEM – TRL 8: Prototype stage, expected to advance significantly over the next decade.

This shows that while AWE, PEM, and SOEC are ready for global deployment, AEM holds disruptive potential for the future.

Which Companies Are Leading in Next Generation Hydrogen Electrolysis?

Global corporations are positioning themselves as leaders in the hydrogen race.

- AWE leaders: Thyssenkrupp Nucera, Linde, INEOS, Asahi Kasei.

- PEM leaders: Siemens Energy, Bosch, Plug Power, Shell Global, ITM Power.

- SOEC leaders: Bloom Energy, Topsoe, Ceres Power, FuelCell Energy.

- Cross-sector leaders: PetroChina, Sinopec, CNOOC, Aramco.

These companies are investing billions into projects that will define the hydrogen landscape of the next two decades.

Which Startups Are Driving Innovation?

Startups are accelerating the development of disruptive solutions in hydrogen electrolysis.

- Stargate Hydrogen – Alkaline systems with high efficiency.

- Verdagy – Large-scale dynamic alkaline electrolyzers.

- Cipher Neutron – Pioneering work in AEM electrolysis.

- Versogen and Ionomr Innovations – Advanced membranes for next-gen systems.

- Greenzo Energy, H2Electro, MOOR, Electric Hydrogen – Pushing scalable hydrogen production for industry.

These startups demonstrate agility in tackling cost, efficiency, and scalability challenges.

How Are Universities and Consortia Supporting Growth?

Universities and research collaborations are essential in building the foundation for commercialization.

- TU Eindhoven – Advanced alkaline designs.

- University of Bath – Leading UK’s hydrogen research hub.

- Yonsei University – High-temperature SOEC studies.

- TU Delft – Renewable-hydrogen integration projects.

- University of Wollongong – Capillary-fed electrolyzers with 95% efficiency.

- Imperial College London and KIT – Breakthrough research in PEM and SOEC.

Consortia such as the Clean Hydrogen Partnership, H2Giga, and DOE Hydrogen Hubs bring together governments, companies, and academia to accelerate deployment.

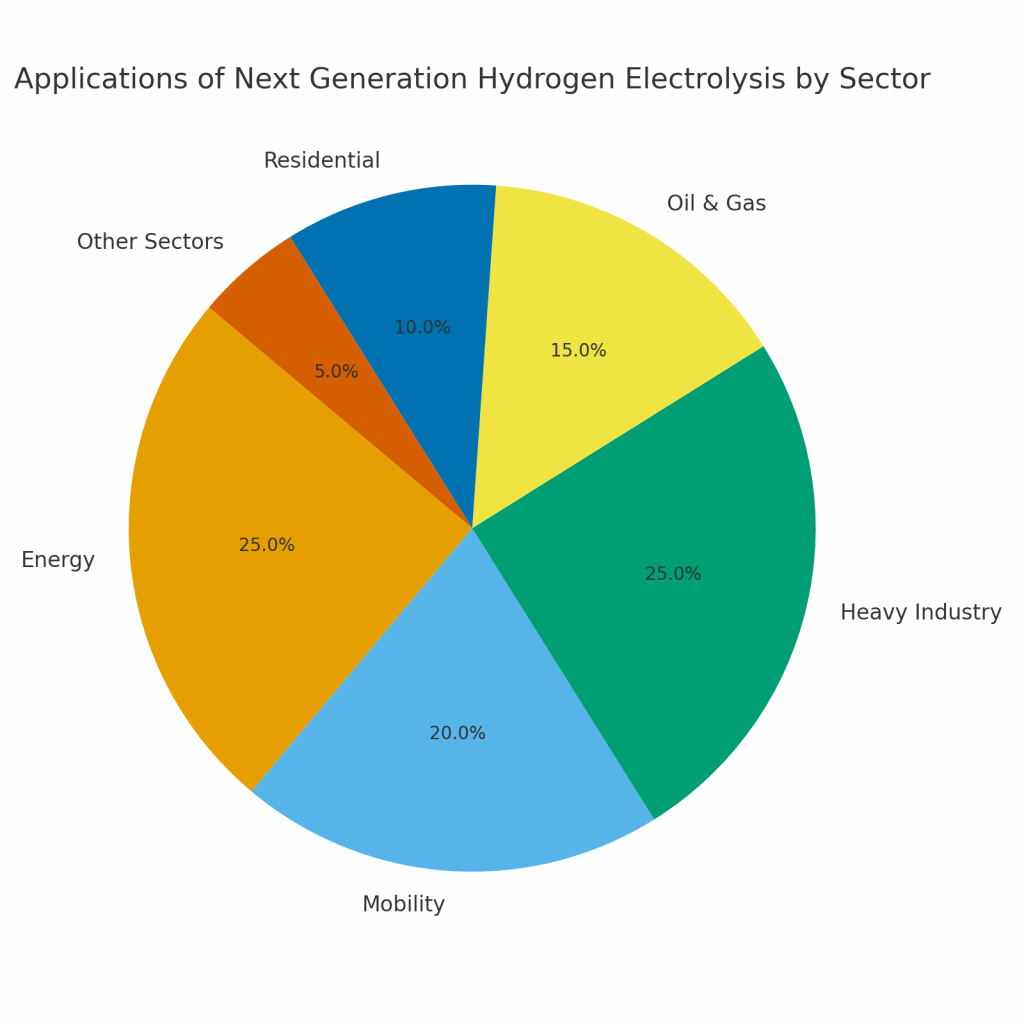

What Are the Applications of Next Generation Hydrogen Electrolysis?

The versatility of green hydrogen makes its applications nearly limitless.

- Energy sector: Renewable storage, microgrids, grid balancing.

- Mobility: Hydrogen fuel cell cars, buses, trains, ships, and even aircraft.

- Heavy industries: Steel, cement, glass, fertilizers, and chemicals.

- Oil and gas: Refining, hydrotreating, desulfurization.

- Residential: Heating, cooling, and appliances powered by hydrogen.

- Other sectors: Defense, medical, biotechnology, and 3D printing.

This broad adoption potential explains why governments and corporations are racing to scale the technology.

What Standards Are Emerging for Hydrogen Electrolysis?

Standards and regulations are critical for safety, efficiency, and international adoption.

- ISO 22734 – Safety of hydrogen generators.

- IEC 62282 – Performance standards.

- ISO 14687 – Fuel purity requirements.

- EN 50549 – Grid integration protocols.

- India’s IS 16509 and IS 16253 – Hydrogen safety and detection.

These global standards are creating trust and enabling market growth.

How PatentsKart Can Help You Navigate the Hydrogen Economy

In such a fast-moving field, protecting innovation and staying ahead of competitors is vital. PatentsKart provides specialized support in the hydrogen space through:

- Patent landscape studies – Spotting trends and identifying opportunities.

- Competitor benchmarking – Tracking global IP leaders.

- Freedom-to-operate analysis – Ensuring compliance before commercialization.

- Strategic IP advisory – Helping both startups and corporations secure defensible positions in the market.

With deep expertise in energy and hydrogen patents, PatentsKart ensures innovators can grow confidently in the hydrogen economy.

Conclusion

The clean energy transition is impossible without hydrogen, and Next Generation Hydrogen Electrolysis is the key technology that makes it viable at scale. With mature options like AWE, PEM, and SOEC already commercial, and emerging solutions like AEM promising disruption, the global hydrogen economy is set to expand rapidly.

For industries, governments, and innovators, the time to invest is now. And with the right intellectual property strategy, companies can secure their place in the hydrogen revolution.

FAQs

1. What is the most advanced type of Next Generation Hydrogen Electrolysis?

PEM electrolysis is currently the most advanced, with strong adoption and efficiency.

2. How does Next Generation Hydrogen Electrolysis support net zero goals?

It enables the production of carbon-free hydrogen, replacing fossil fuels across industries and transportation.

3. Which companies are leading in hydrogen electrolysis innovation?

Global leaders include Siemens Energy, Shell, Plug Power, Linde, Bloom Energy, and startups like Verdagy and Cipher Neutron.

4. What are the biggest challenges in scaling hydrogen electrolysis globally?

electrolysis globally?

Challenges include high initial costs, rare material supply chains, and the need for supportive infrastructure.

5. How can PatentsKart help businesses in the hydrogen electrolysis sector?

PatentsKart provides IP analysis, competitor tracking, and freedom-to-operate studies to help businesses secure long-term success.