What are Over-the-Air (OTA) Software Updates in Vehicles?

Over-the-Air (OTA) Software Updates in Vehicles are wireless updates that enable automakers to remotely upgrade, fix, or enhance a vehicle’s software without the driver needing to visit a service center. Just like smartphones receive system or app updates, modern vehicles equipped with connectivity can download and install improvements directly through the internet. This allows manufacturers to continuously refine vehicle performance, introduce new features, and strengthen cybersecurity — all with minimal effort from the driver.

The core idea behind OTA updates is convenience and efficiency. Traditionally, software-related issues in cars required physical recalls or manual updates at dealerships, costing manufacturers time and customers valuable driving experience. With OTA, automakers can instantly roll out critical patches, update navigation maps, improve fuel efficiency, enhance infotainment systems, or even unlock new driving modes. Drivers benefit from a car that feels smarter and safer over time, while manufacturers save millions by reducing large-scale recall costs.

Security also plays a central role. As vehicles become more connected and rely on AI-driven systems, OTA updates act as a safeguard against vulnerabilities by allowing quick fixes against emerging cyber threats. Beyond safety, OTA opens the door to personalization — automakers can tailor software to individual driver preferences or regional requirements, ensuring a more adaptive ownership experience.

In short, OTA software updates transform vehicles into upgradeable digital platforms. Instead of being static machines, cars now evolve dynamically, staying current with the latest innovations long after leaving the showroom. This technology is redefining the automotive industry, paving the way for connected, intelligent, and future-ready mobility.

What Market Trends are Driving OTA Software Updates in Vehicles?

Several forces are pushing the adoption of OTA solutions across the automotive landscape:

- Rising demand for connected vehicles – Over 400 million connected cars are expected on roads globally by 2030.

- Shift to software-defined vehicles (SDVs) – Cars are increasingly being built around software platforms, making OTA essential.

- Regulatory pressures – Safety agencies encourage timely cybersecurity updates to reduce recall-related risks.

- Consumer expectations – Drivers now expect vehicles to stay updated like smartphones.

- New monetization models – Subscription-based features, on-demand upgrades, and digital services boost OEM revenues.

The global market for OTA in vehicles is projected to grow exponentially over the next decade, driven by these converging trends.

How Does Patent Activity Reflect Innovation in OTA Software Updates?

Patent filings offer a lens into technological momentum. The report highlights strong IP activity in domains like cybersecurity, infotainment, and telematics.

- Patent growth surged after 2015 as connectivity became mainstream.

- Focus areas: secure communication protocols, modular software platforms, over-the-air diagnostics, and fail-safe update systems.

- Regional leaders: The U.S., Europe, Japan, South Korea, and China dominate patent filings.

Key companies with strong patent portfolios include Bosch, Continental, Harman, Qualcomm, Samsung, and Tesla. Startups and Tier-1 suppliers are also actively filing to protect their innovations in OTA frameworks and cybersecurity.

What Do Technology Readiness Levels (TRL) Indicate?

The TRL framework shows how mature OTA systems are across vehicle domains:

- Infotainment updates – TRL 9, already commercialized in most modern cars.

- Telematics control units (TCUs) – TRL 9, widespread in connected vehicle platforms.

- ADAS and autonomous driving modules – TRL 7–8, piloted in premium vehicles but still evolving.

- Battery management and powertrain updates – TRL 7–8, expanding with EV adoption.

- Cybersecurity OTA solutions – TRL 7–9, depending on application maturity.

This maturity map shows that while infotainment and telematics are established, advanced OTA for critical driving systems is still progressing.

Which Companies are Leading the OTA Software Update Market?

Several established players are spearheading OTA adoption:

- Automakers: Tesla, BMW, Mercedes-Benz, Ford, Toyota, Hyundai, General Motors.

- Tier-1 suppliers: Bosch, Continental, Denso, Harman, Aptiv.

- Tech companies: Qualcomm, Nvidia, Samsung, Blackberry QNX.

These players are developing in-house solutions or partnering with software specialists to build secure and scalable OTA platforms.

Which Startups are Innovating in OTA Software Updates?

Startups are emerging as important disruptors, bringing agility and specialized focus:

- Airbiquity – Connected vehicle services and secure OTA frameworks.

- Aurora Labs – AI-driven predictive OTA solutions.

- Karamba Security – Cybersecurity for OTA and ECUs.

- Excelfore – Middleware solutions for connected cars and OTA.

- Upstream Security – Cloud-based OTA monitoring and threat detection.

These startups often collaborate with OEMs and Tier-1s, accelerating adoption of next-generation OTA systems.

How Are Universities and Research Labs Contributing?

Academic institutions are also playing a role in advancing OTA technology:

- TU Munich and Fraunhofer Institutes – Research in automotive cybersecurity and secure OTA delivery.

- MIT and Stanford – Innovations in cloud-based mobility platforms.

- University of Tokyo and KAIST – Studies on OTA in autonomous and electric vehicles.

Their work strengthens the ecosystem with cutting-edge research and prototypes.

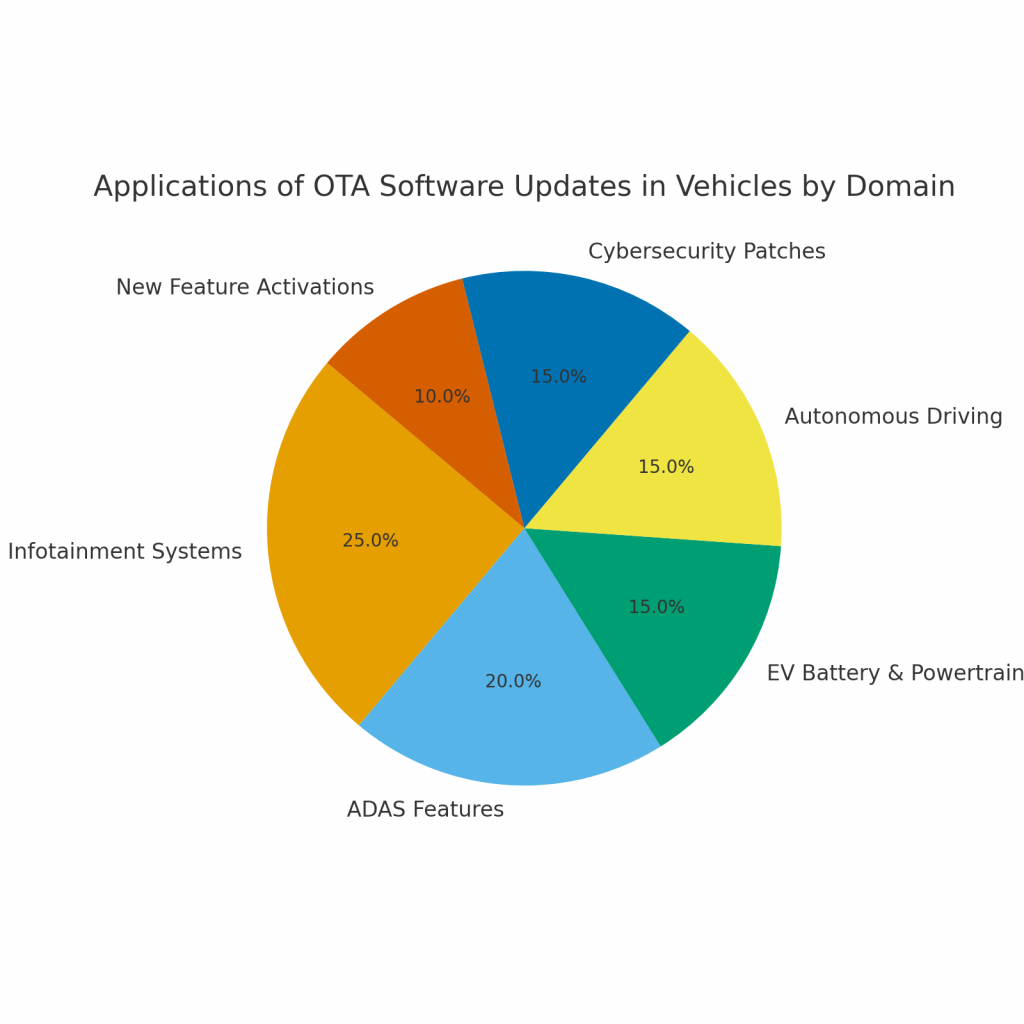

What are the Applications of OTA Software Updates in Vehicles?

OTA updates are not limited to infotainment—they span across multiple domains:

- Infotainment systems – Seamless updates for navigation, entertainment, and voice assistants.

- Advanced driver assistance systems (ADAS) – Updates for lane-keeping, adaptive cruise control, and parking assist.

- Electric vehicle (EV) management – Enhancing battery life, charging optimization, and thermal control.

- Autonomous driving features – Remote calibration and algorithm enhancements.

- Cybersecurity patches – Protecting vehicles from evolving cyber threats.

- New feature activations – Post-purchase upgrades such as heated seats or performance boosts.

This broad range of applications demonstrates the central role OTA will play in the era of software-defined mobility.

What Standards and Regulations are Shaping OTA Adoption?

Standardization is vital to ensure secure and reliable OTA deployment. Key frameworks include:

- ISO/SAE 21434 – Road vehicle cybersecurity engineering.

- UNECE WP.29 – Regulations on cybersecurity and software updates.

- ISO 24089 – Software update engineering for vehicles.

- AUTOSAR Adaptive Platform – Common software architecture for automotive.

These standards are essential for global harmonization, safety, and consumer trust.

How PatentsKart Can Help in the OTA Software Update Landscape

The competitive intensity in Over-the-Air (OTA) Software Updates in Vehicles means protecting intellectual property is mission-critical. PatentsKart offers specialized expertise to help companies:

- Conduct patent landscape analysis – Identify white spaces and innovation opportunities.

- Benchmark competitors – Track global IP strategies of leading OEMs and suppliers.

- Perform freedom-to-operate (FTO) searches – Reduce litigation risks.

- Develop IP strategies – Align innovation with business goals for long-term advantage.

With PatentsKart’s guidance, automotive innovators can confidently expand their OTA solutions while securing strong market positions.

Conclusion

Over-the-Air (OTA) Software Updates in Vehicles are redefining the automotive sector, shifting it from hardware-driven machines to software-defined platforms. With benefits ranging from cost savings to enhanced consumer experiences, OTA is no longer optional—it’s becoming a necessity.

As automakers, suppliers, startups, and regulators converge to build a secure OTA ecosystem, the industry is moving toward vehicles that continuously improve throughout their lifecycle. For businesses looking to innovate in this space, a robust IP strategy is essential—and PatentsKart is here to make that journey seamless.

FAQs

1. What are Over-the-Air (OTA) Software Updates in Vehicles?

They are wireless software updates delivered to a vehicle’s systems via cellular or Wi-Fi, eliminating the need for dealership visits.

2. How do OTA updates benefit consumers and automakers?

They improve safety, reduce maintenance costs, enable new features, and create new revenue models for automakers.

3. Which companies are leading in OTA software solutions?

Tesla, BMW, Mercedes-Benz, Ford, Bosch, Continental, Qualcomm, and startups like Aurora Labs and Airbiquity.

4. What challenges exist in scaling OTA software updates?

Cybersecurity risks, regulatory compliance, and the complexity of updating safety-critical systems.

5. How can PatentsKart support businesses in the OTA ecosystem?

By providing IP analysis, competitor benchmarking, and freedom-to-operate studies to help innovators secure their position in this evolving market.