What is a smart implant and why does it matter?

A smart implant is an implantable medical device that combines sensing, local processing, and communication to monitor physiology and, when required, deliver therapy. Beyond passive hardware, a smart implant turns data into decisions at the point of care. That capability reduces hospital visits, supports personalized treatment, and enables remote management.

How does a implantable device work technically?

Most devices pair microsensors with embedded electronics and a power solution. Sensors capture electrical, chemical or mechanical signals. On-board processors filter and extract actionable features. Wireless telemetry or near-field links send summarized data to external hubs. Some systems support closed-loop control, where sensing and therapy happen automatically. Engineers optimize sensing chains with adaptive filtering and event-driven telemetry to minimize power draw while preserving clinical signal fidelity across daily activities.

What clinical problems can a smart implant solve today?

Current clinical value is clearest in chronic conditions that require continuous or frequent monitoring. Cardiac rhythm devices detect arrhythmias and adjust pacing. Closed-loop insulin delivery combines sensors and pumps to stabilize blood glucose. Neurostimulation systems reduce seizures or manage movement disorders. Orthopedic sensors help detect implant loosening or infection earlier than traditional methods. Evidence shows that closed-loop therapeutic systems reduce symptom burden and improve functional outcomes when algorithms are tuned to patient-specific biomarkers and care pathways.

Which companies and startups are building smart implants?

The ecosystem includes large medtech firms and nimble startups. Established device companies bring regulatory experience and manufacturing scale. Startups focus on novel sensors, miniaturized electronics and AI-driven decoding. Collaborations and licensing deals are common as incumbents accelerate innovation through partnerships. Industry partnerships often include shared validation protocols and co-developed clinical trials that reduce duplication and accelerate regulatory dossiers for new platforms.

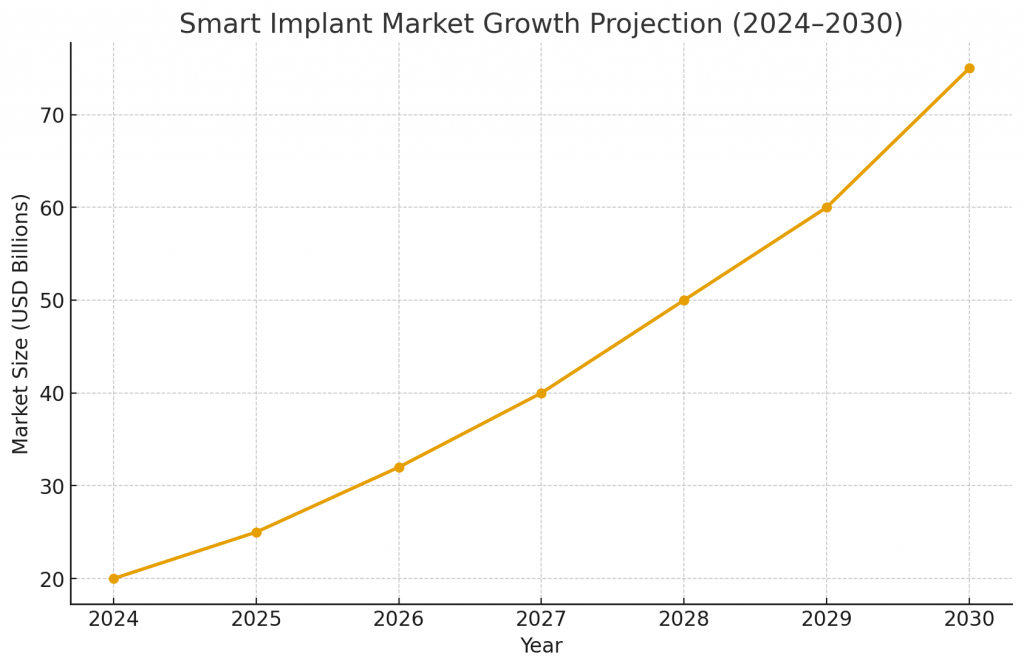

How big is the market for smart implants and where is it growing?

Market growth is driven by aging demographics, chronic disease prevalence and demand for remote care. Segments such as cardiac, diabetes and neuromodulation show immediate commercial traction. Adoption is also shaped by reimbursement models that reward outcomes and remote monitoring. As component costs fall and regulatory pathways become clearer, the addressable market widens. Payers increasingly request evidence of cost savings and reduced hospitalization days, so economic modeling should be embedded early in development to support reimbursement discussions.

What technology readiness levels apply to smart implant categories?

Diagnostic and monitoring implants often reach TRL 8–9 because the sensing modalities and safety profiles are well established. Therapeutic implants with a history of clinical use (for example, cardiac pacemakers and deep brain stimulators) also sit at high TRL. Augmentative or cognitive interfaces, by contrast, are frequently at TRL 5–7, requiring more clinical validation. High TRL modalities benefit from improved manufacturing yield, standardized test fixtures and scalable traceability processes that shorten time-to-market when design is validated.

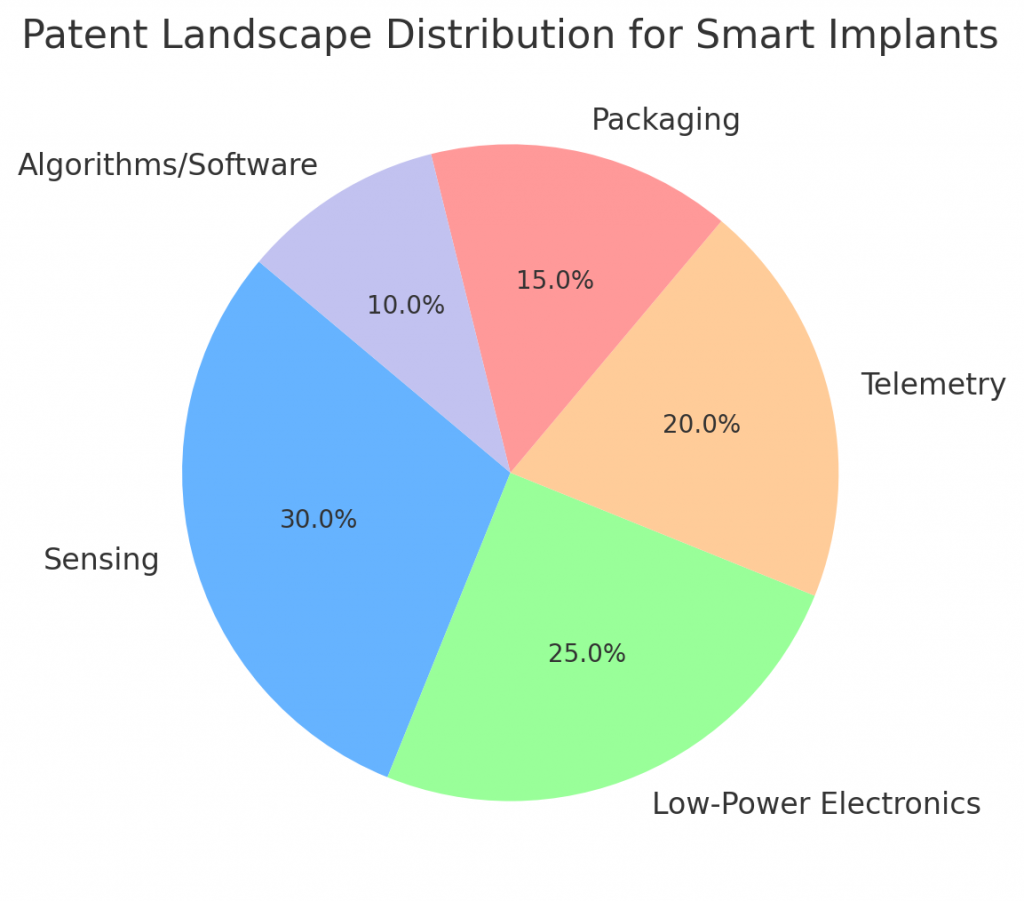

What does the patent landscape for smart implants show?

Patents cluster around sensor chemistry, low-power electronics, telemetry, sealing and biocompatible packaging. Large companies protect system-level claims and manufacturing processes. Startups usually file on novel materials, algorithmic decoding and unique therapeutic combinations. A careful freedom-to-operate search can reveal white space, particularly around software integration and specific use-cases. Patent strategies should focus on modular claims that protect core analytics, unique sensor chemistry and methods of integrating signals to trigger therapeutic actions.

Which companies and startups are building smart implants?

The smart implant ecosystem includes both established medtech leaders and disruptive startups.

Established Companies

- Medtronic – advancing neuromodulation and cardiac rhythm implants.

- Abbott – leading in glucose monitoring and cardiac implants.

- Boston Scientific – strong in neurostimulation and orthopedic sensors.

- Stryker and Zimmer Biomet – focused on orthopedic and spine smart implant solutions.

- Cochlear – pioneering hearing restoration implants.

Startups and Emerging Players

- Neuralink and Synchron – developing brain-computer interfaces.

- Blackrock Neurotech and Paradromics – innovating in neural decoding and restoration.

- Beta Bionics – advancing artificial pancreas systems.

- Neuspera – working on miniaturized wireless implants.

- Magenta Medical – focused on cardiac support systems.

- Fire1 – targeting smart implantable monitors for heart failure.

- Re-Vana Therapeutics – building long-acting ocular drug delivery implants.

These players represent the dual push in this sector: the scale and regulatory depth of incumbents combined with the speed and novel science of startups.

What standards and regulations apply to smart implants?

Manufacturers must comply with established medical-device standards for active implants, electrical safety and biocompatibility. Cybersecurity guidance and interoperability standards are increasingly relevant. Regulatory agencies also expect robust post-market surveillance, especially for devices that continuously collect patient data. International standards for electromagnetic compatibility, hermeticity and long-term corrosion resistance are technical checkpoints that must be demonstrated before broad clinical use.

How does cybersecurity influence smart implant deployment?

Security design is mandatory because implants handle sensitive data and can, in some cases, accept control commands. Designers use encryption, secure boot, authenticated updates and layered access controls. Demonstrable security posture reduces regulatory risk and builds clinician and patient trust. Security reviews should include threat modeling, tamper-detection capabilities and a documented plan for incident response and coordinated disclosures with regulators.

What materials and manufacturing challenges must be solved for smart implants?

Materials must be biocompatible, durable and compatible with miniaturized packaging. Hermetic sealing and flexible interconnects are technical priorities. Manufacturing must meet high yields and traceability standards because failure rates directly affect patient safety. Advanced materials science contributes coatings and substrates that reduce fibrotic encapsulation, improving long-term sensor performance and minimizing drift over years.

How do clinical trials and evidence generation differ for smart implants?

Trials for implantable devices demand staged evidence: bench validation, animal models, feasibility trials and pivotal studies. Clinical endpoints may include device performance metrics, patient-reported outcomes and health-economic measures. Planned registries help capture long-term safety and effectiveness. Clinical programs often pair objective device metrics with patient-reported outcome measures to capture both biological effect and the lived experience of therapy.

What ethical considerations accompany smart implant use?

Ethical issues include informed consent, privacy, autonomy and potential long-term cognitive effects for augmentative devices. Equitable access is a concern as advanced implants can be expensive. Transparent governance and benefit-sharing models reduce social friction and support ethical adoption. Ethical review boards increasingly consider societal impact and equitable access in their assessments of first-in-human studies for novel implantable platforms.

What investment and commercialization strategies work best for smart implant startups?

Startups should focus on a single, high-value indication, demonstrate clinical benefit, and secure regulatory expertise early. Partnering with established manufacturers shortens time-to-market. Investors prize teams that can show reimbursement pathways and defendable IP around system integration and algorithms. Smart manufacturing and automation reduce per-unit variability and lower barriers for small companies to produce devices under strict medical-quality standards.

What early applications should companies prioritize for smart implants?

Prioritize applications with clear clinical pathways and measurable outcomes. Cardiac rhythm management, closed-loop metabolic control and movement-disorder neuromodulation are strong candidates. These use-cases combine clinical need, large populations and established reimbursement pathways. Selecting pilot sites with experienced investigators and existing device registries can dramatically streamline patient recruitment and data harmonization across studies.

How will smart implants integrate with broader digital health ecosystems?

Implants will stream summaries or events to cloud platforms, feeding analytics that inform care plans. Interoperability and standard data models minimize friction. Integration enables predictive maintenance and population-level insights while preserving patient privacy. Data integration with hospital systems requires mapping, secure APIs and clinician-facing dashboards to summarize events without overwhelming teams with raw telemetry.

What are common failure modes and maintenance requirements for smart implants?

Typical failure modes include battery depletion, lead or connector fatigue, sensor drift and infection. Designers build redundancy, remote diagnostics and clear maintenance protocols to manage risk. Some devices are intentionally bioresorbable to remove the need for retrieval surgery. Maintenance programs combine scheduled check-ins, remote diagnostics and consumable replacement plans to ensure sustained device reliability in distributed care settings.

How should IP strategy be structured for smart implant programs?

Combine composition and system claims with method-of-use and manufacturing patents. Patent algorithms that are central to closed-loop control and protect unique packaging or power management. Trade secrets for calibration processes also offer long-term advantage. An effective IP portfolio balances patents with trade secrets for calibration routines, manufacturing jigs and proprietary training data used by analytics.

What partnerships accelerate smart implant scale-up?

Key partners include contract manufacturers, semiconductor vendors, clinical research organizations and insurers. Early partnership agreements for pilot manufacturing and reimbursement pilots help derisk commercialization. Academic collaborations remain vital for foundational research and device validation. Cross-sector consortia and academic networks help share anonymized datasets and best practices, accelerating algorithm validation and regulatory acceptance.

How should healthcare systems prepare to adopt smart implants at scale?

Health systems must build infrastructure for secure data ingestion, establish device workflows and train clinicians. Biomedical engineering teams need clear responsibilities for device management and support. Payer engagement ensures pilots capture health-economic outcomes that justify broader adoption. Health systems should plan for operational workflows, training, and the technical support necessary to ensure rapid and safe device rollouts.

How can PatentsKart help with smart implant programs?

PatentsKart delivers IP landscape studies, freedom-to-operate clearance, and patent prosecution tailored to medical-device innovation. We map competitor claim clusters, prioritize filings aligned with TRL milestones, and draft defensive claims around systems, algorithms and manufacturing. We also advise on licensing strategies, due diligence for investments and alignment with reimbursement planning. Our work links IP strategy to regulatory milestones, clinical evidence requirements and commercial positioning so teams can scale with confidence.

Conclusion

Smart implant technology is maturing in focused clinical domains. Successful commercialization combines technical robustness, strong clinical evidence, regulatory readiness and strategic IP. Teams that coordinate these elements will accelerate patient benefit and create defensible commercial positions. Early planning across engineering, clinical, regulatory and reimbursement streams converts prototypes into sustainable products.

FAQ

1. What is a smart implant and how does it differ from a traditional implant?

A smart implant adds sensing, logic and communication to traditional implant functions. It enables active monitoring, closed-loop therapy and remote diagnostics that passive devices cannot provide.

2. What are the most promising clinical uses for a smart implant today?

Cardiology, diabetes management and neurostimulation currently offer the clearest clinical and commercial pathways. These areas have precedent for reimbursement and measurable outcomes.

3. What standards and regulations apply to a smart implant?

Manufacturers must follow standards for active implantable devices, electrical safety, biocompatibility and cybersecurity. Regulatory filings typically require bench, animal and human studies plus robust post-market surveillance.

4. How long does it take to bring a smart implant to market?

Development timelines range from three to seven years depending on novelty and required clinical evidence. Predicate device pathways or breakthrough designations can shorten that timeframe.

5. What should investors look for in a smart implant startup?

Investors should assess regulatory experience, reimbursement strategy, strong clinical collaborators and defensible IP. A clear manufacturing plan and early payer engagement also reduce commercial risk.