What Are Sustainable Biomaterials and Why Do They Matter?

Industries are under pressure to reduce emissions, eliminate waste, and build resilient supply chains. Sustainable Biomaterials provide a credible path forward by drawing on renewable feedstocks such as plants, fungi, algae, and engineered microbes.

Unlike petroleum-heavy inputs, these new material families can lower carbon footprints, support circular design, and introduce novel functionality. Governments, investors, and brands now treat this domain as strategic to both climate targets and long-term competitiveness. Sustainable Biomaterials

How Do They Compare to Traditional Materials?

Conventional plastics and synthetics have dominated for cost and durability, but they also drive pollution and resource depletion. In contrast, Sustainable Biomaterials bring advantages that align with modern policy and consumer expectations:

- Renewable sourcing: Feedstocks can be regrown or cultivated.

- Lower emissions: Bio-based routes can reduce lifecycle greenhouse gases.

- End-of-life options: Compostability or recyclability where infrastructure exists.

- Engineered performance: Tunable strength, barrier behavior, and antimicrobial surfaces.

These benefits explain why procurement teams are testing bio-derived alternatives in parallel with recycling and reuse initiatives.

What Are the Leading Applications Right Now?

Commercial traction is broad. Packaging moves fastest, followed by textiles, healthcare, construction, and energy systems. As pilot lines become standardized, Sustainable Biomaterials migrate from niche pilots to portfolio staples across multiple product categories.

Typical use cases include compostable films, mycelium foams, algae- or cellulose-based fibers, protein-derived threads, tissue-engineering scaffolds, and bio-cement composites.

How Are They Transforming Packaging and Logistics?

Packaging is the most visible proving ground. Brands are rolling out PLA films from sugars, PHA plastics produced via fermentation, starch blends that biodegrade under controlled conditions, and mushroom-based foams that replace polystyrene.

Regulation is a tailwind: bans on single-use items and extended producer responsibility encourage trials at scale. Adoption accelerates when logistics teams confirm that lighter components cut shipping emissions without compromising protection—one of many reasons Sustainable Biomaterials are gaining traction in this segment.

Where Do They Fit in Textiles and Fashion?

Fashion faces scrutiny for waste and water use. Bio-derived fibers and next-gen leathers help shift the narrative. Algae yarns and regenerated cellulose reduce dependence on oil-based threads; mycelium leather and fruit-waste composites offer vegan alternatives.

Performance matters: breathability, drape, and durability must meet or exceed incumbent fabrics. When LCA data confirms lower impact at equal quality, adoption rises—especially when Sustainable Biomaterials enable mono-material garments that simplify end-of-life processing.

How Are They Used in Healthcare and Life Sciences?

Clinical use demands safety and reliability. Biocompatible polymers enable targeted drug release, bioresorbable scaffolds support tissue regrowth, and advanced dressings manage moisture while preventing infection.

Hospitals also look for waste reduction. Devices and supplies designed for controlled degradation or material recovery can shrink disposal costs—an area where Sustainable Biomaterials help align patient outcomes with sustainability goals.

What Role Do They Play in Construction and the Built Environment?

Built-world applications range from hemp-lime composites and bio-cements to mycelium insulation. These solutions prioritize thermal performance, acoustic damping, and lower embodied carbon.

Validation is rigorous: codes, safety testing, and multi-decade durability. When pilot projects demonstrate cost predictability and consistent quality, architects gain confidence to specify Sustainable Biomaterials in walls, panels, and fit-outs.

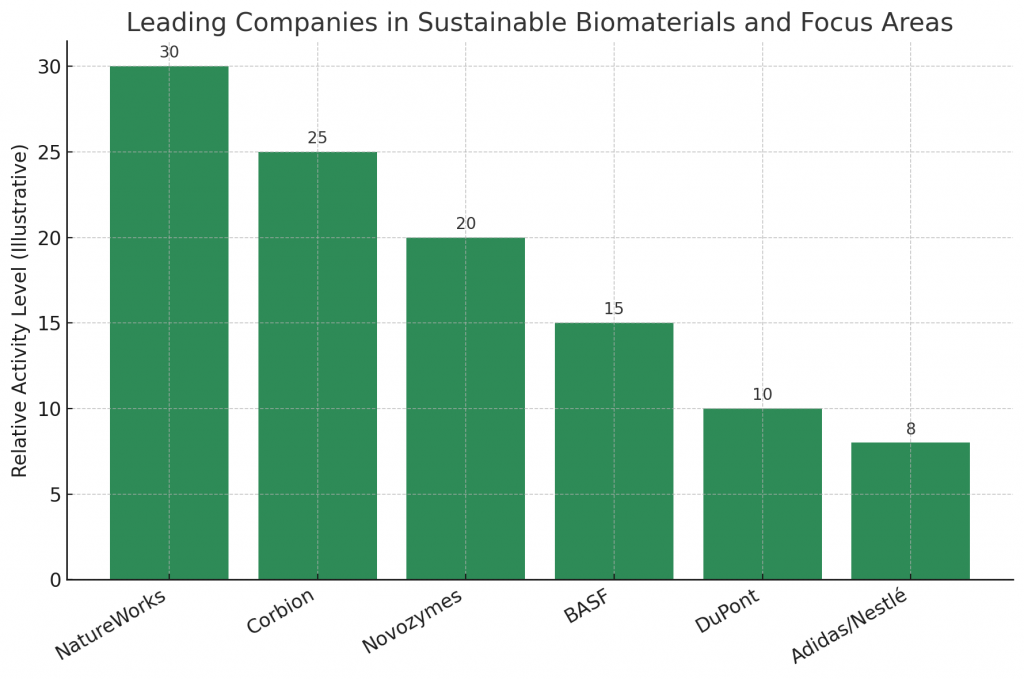

Which Companies Are Leading the Market Today?

Several corporations anchor scale-up and standard setting in the Sustainable Biomaterials sector:

- NatureWorks – Expanding large-scale PLA bioplastic production for packaging and consumer goods.

- Corbion – Driving PHA capacity with fermentation-based processes.

- Novozymes – Leading in enzyme innovation that streamlines bioprocessing.

- BASF – Integrating bio-based intermediates into chemical supply chains.

- DuPont – Innovating with high-performance biopolymers for textiles and industrial uses.

- Apparel & Packaging Brands (like Adidas and Nestlé) – Signing multi-year offtake agreements to stabilize demand and ensure reliable supply.

These partnerships translate research into repeatable operations—one of the clearest signals that Sustainable Biomaterials have moved beyond experimentation into managed growth.

Which Startups Are Redefining the Frontier?

Agile companies push the boundaries with mycelium foams, algae-derived resins, methane-to-PHA platforms, and engineered protein fibers. They move quickly, validate with early adopters, and license or partner for manufacturing.

Investors reward teams that master strain performance, process integration, and brand collaborations—capabilities that shorten the road from lab demo to trusted components powered by Sustainable Biomaterials.

What Do Patents and TRL Levels Reveal About Maturity?

Intellectual property maps the most active innovation zones: fermentation routes for PHA, advanced PLA blends, mycelium growth control, and enzyme-enhanced processing. Technology readiness levels (TRL) show where pilots become plants.

- Packaging: TRL 8–9 with licensed processes and stable quality.

- Textiles: TRL 7–8 as performance metrics approach incumbents.

- Healthcare: TRL 6–7 pending regulatory approvals.

- Construction: TRL 5–6 with expanding demonstrations.

For strategists, combining patent density with TRL data clarifies risk. Portfolios centered on Sustainable Biomaterials can target near-term wins in packaging while incubating higher-value plays in medical and building products.

What Challenges Should Teams Anticipate Before Scaling?

Four hurdles appear most often: cost premiums versus petro-based options; uneven composting and recycling infrastructure; scale-up complexity from 2-liter reactors to 20,000-liter lines; and evolving regulations, especially in health and construction.

These are solvable with disciplined pilots, clear specifications, and supplier scorecards. Early engagement with policymakers and municipalities also helps create the conditions where Sustainable Biomaterials can thrive at city and national levels.

How Do Economics and Supply Chains Change With Bio-Based Inputs?

Unit economics hinge on feedstock price, yield stability, and downstream work-up. Co-product valorization—turning byproducts into revenue—improves margins. Regionalized supply reduces shipping emissions and insulates buyers from commodity shocks.

Smart procurement hedges risk with offtake contracts, diversified suppliers, and performance-linked pricing. As manufacturing learning curves drive costs down, bio-based alternatives compete on more than ethics—they compete on total cost of ownership.

Which Sustainability Metrics Actually Matter?

Credible lifecycle assessment (LCA) underpins claims. Teams track greenhouse gas intensity per kilogram, energy sources, water use, land impact, and end-of-life pathways. Third-party verification and transparent system boundaries build trust.

Design choices improve these scores: mono-material formats, simpler additives, and take-back programs. When data shows advantage at equal performance, category managers gain confidence to standardize Sustainable Biomaterials across SKUs.

What Does the Next Decade Look Like?

Near term, expect wider use in food wraps, e-commerce mailers, and breathable apparel. Mid term, watch for medical devices and structural panels that pass rigorous validation. Longer term, hybrid systems that pair electrosynthesis with biology may unlock tougher carbon problems.

As costs fall and reliability rises, procurement will treat Sustainable Biomaterials as a design space: specify properties, source from certified suppliers, and integrate digital traceability from plant to product.

How Can PatentsKart Help You Build a Winning Strategy?

PatentsKart supports executives, IP teams, and product leaders at every stage—from exploration to scale. Our services de-risk investments and accelerate time to value:

- Patent landscape & white-space mapping to pinpoint opportunity.

- Freedom-to-operate reviews across priority markets.

- Competitive intelligence on filings, partnerships, and pilot progress.

- TRL-aligned roadmaps that connect lab milestones to commercial gates.

- Deal support for licensing, supplier diligence, and JVs.

With focused research and actionable recommendations, we help clients turn Sustainable Biomaterials programs into reliable revenue.

Conclusion

The shift from extraction to regeneration is underway. Organizations that master bio-based inputs, disciplined pilots, and honest measurement will lead their categories. Sustainable Biomaterials are not a novelty; they are a scalable toolkit for building lower-carbon, higher-performance products.

By pairing sound economics with transparent data, teams can move beyond experiments and standardize solutions that customers prefer. With the right partners, Sustainable Biomaterials become a durable competitive edge.

FAQs

Q1. What are Sustainable Biomaterials in simple terms?

They are materials made from renewable biological sources designed to reduce environmental harm while meeting real-world performance needs.

Q2. Which sectors adopt bio-based materials the fastest?

Packaging leads, followed by textiles, healthcare, and the built environment.

Q3. What slows adoption the most?

Cost premiums, uneven infrastructure, and scale-up complexity—issues that disciplined pilots and the right partners can mitigate.

Q4. How do patents and TRL levels reduce risk?

Patents protect know-how; TRL benchmarks show whether a solution is lab-ready, pilot-proven, or plant-validated.

Q5. How can PatentsKart support long-term success with renewable materials?

We connect IP strategy, FTO, and commercialization roadmaps so teams can scale confidently—from first pilot to global rollout of Sustainable Biomaterials.